BROKER INSURANCE SOFTWARE

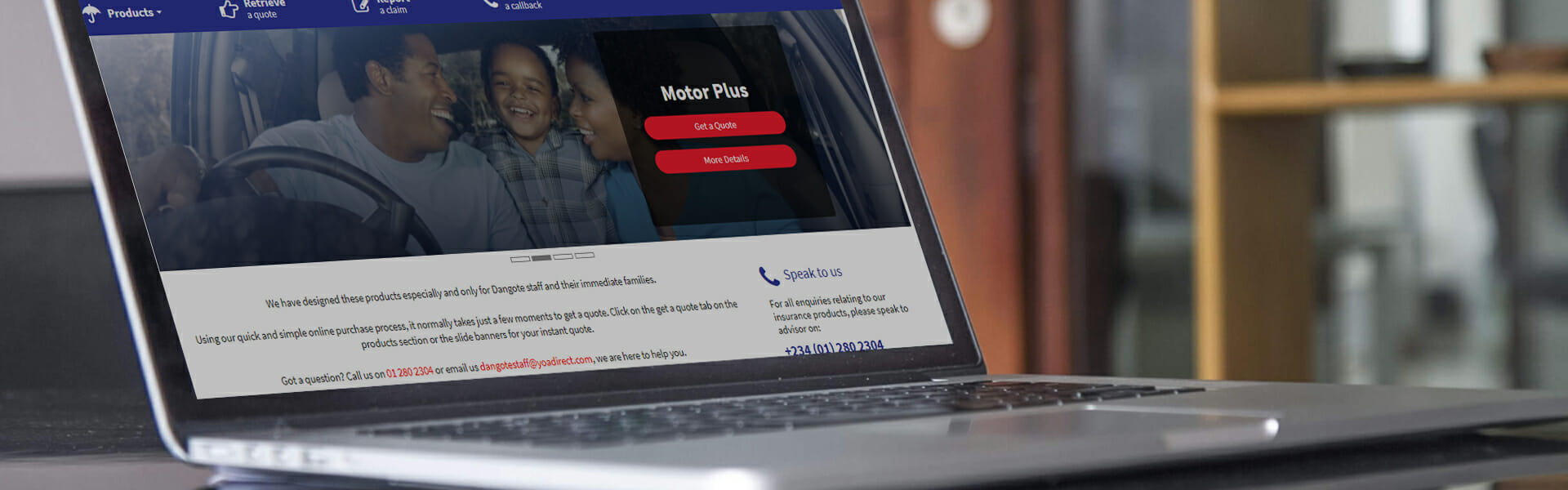

Developing bespoke broker insurance software for global brand

Managing the customer journey from lead to sale

Working with

The project at-a-glance

- £2m contract

- Technical partner alongside JLT

- Creation of bespoke customer, broker and admin system

- Built in ASP.NET

- Multichannel software manages entire journey from lead creation to sale closure

- YOA has experienced uplift in staff productivity, customer numbers and insurer partnerships

The requirement

When Nigeria’s leading insurer – YOA Insurance – sought a robust policy management system capable of managing the customer journey from the point of lead creation to final offer, they turned to IDS.

Their brief was broker insurance software that could manage the selling and handling of insurance policies, cater for a complex onboarding experience, catalogue a range of insurance services from home to marine cargo, and fully automate the process from end to end.

Admin users also needed the ability to produce and access reports, check audit logs, allocate permissions, import leads and policies, and create bespoke insurance campaigns.

Our solution

With a bold technology roadmap, we adopted an agile software development approach – focusing in the first instance on the design and build of a business-critical application that enabled staff to construct insurance policies from their impressive catalogue.

When this fundamental tool was in place, additional functionality was added with each iteration. Extensive research underpinned our user-centred focus from start to finish. We paid close attention to customers’ interactions with YOA Insurance, for example, to better understand their needs and uncover pain points within the existing system.

Here, we learnt more about leading customers and their complex insurance requirements, in comparison to individuals’ more simplistic insurance priorities. It was clear that system flexibility and adaptability would therefore be key.

The results

By leveraging technology to streamline the process and reduce administrative burdens for colleagues at every possible step, IDS has delivered a system which allows the business to concentrate on what it needs to do – selling the right insurance premiums to customers, while delivering the best possible level of service.

Not only that, but time savings equating to 57% greater productivity mean YOA Insurance can handle more leads, help more people and, ultimately, scale the business with ease.

The team can now market and sell policies via different sales channels including the public domain, workspace and telesales, and leads are logged and nurtured through the system with the help of automated internal and external communications, an SMS portal and telesales area – to name just a few.

The comprehensive policy management software also includes a private area for customers; an internal system for agents to oversee claims, renewals, upgrades and so on; plus a secure billing engine with integrated payment gateway and financial reporting.